Understanding the Different Types of Mortgages Available

When it comes to buying a property in the UK, many people will require a mortgage to help fund their purchase.

Mortgages are a type of loan specifically designed for property purchases, and they come in many different types. Understanding the different types of mortgages available can help you choose the right one for your needs.

There are various types of mortgages available in the UK, each with its own advantages and disadvantages. From fixed-rate mortgages to tracker mortgages, offset mortgages, and more, it’s important to understand the features and benefits of each type to help you make an informed decision.

Factors such as your financial situation, income, credit score, and the size of your deposit will all play a role in determining which type of mortgage is right for you.

Types of Mortgages

Fixed Rate Mortgages

A fixed rate mortgage is a type of mortgage where the interest rate is fixed for a set period of time. This means that your monthly mortgage payments will remain the same for the duration of the fixed rate period, regardless of any changes to interest rates.

Fixed rate mortgages are popular because they provide certainty and stability, and can help borrowers budget effectively.

However, it’s worth noting that fixed rate mortgages often have higher interest rates than other types of mortgages, particularly if you opt for a longer fixed rate period.

Tracker Mortgages

A tracker mortgage is a type of variable rate mortgage which “tracks” a base rate – usually the Bank of England’s base rate. This means that your mortgage payments could go up or down depending on changes to the base rate.

Tracker mortgages are often linked to the base rate for a set period of time, typically two or five years, after which they may switch to your lender’s standard variable rate.

Tracker mortgages can be attractive to borrowers who want to take advantage of low interest rates, but they can also be risky if the Bank of England’s base rates rise.

Discount Mortgages

A discount mortgage is another type of variable rate mortgage, where the interest rate is set at a discount to the lender’s standard variable rate (SVR) for a set period of time.

For example, if the lender’s SVR is 4%, a discount mortgage might offer an interest rate of 3%.

Discount mortgages can be a good option for borrowers who want to benefit from lower interest rates, but they can be risky if interest rates rise.

Standard Variable Rate Mortgages

A standard variable rate mortgage is the default interest rate that a lender will offer you after any introductory deal period has ended.

This means that your mortgage payments could go up or down at any time, depending on changes to the lender’s SVR.

Standard variable rate mortgages are often more expensive than other types of mortgages, but they can offer flexibility, as there are usually no early repayment charges.

Offset Mortgages

An offset mortgage is a type of mortgage where your savings and mortgage are combined into one account. Your savings are used to offset the balance of your mortgage, which reduces the amount of interest you pay.

For example, if you have a mortgage of £150,000 and savings of £20,000, you would only pay interest on £130,000. Offset mortgages can be a good option for borrowers who have significant savings, as they can help reduce the amount of interest they pay and potentially reduce the term of their mortgage.

Interest-Only Mortgages

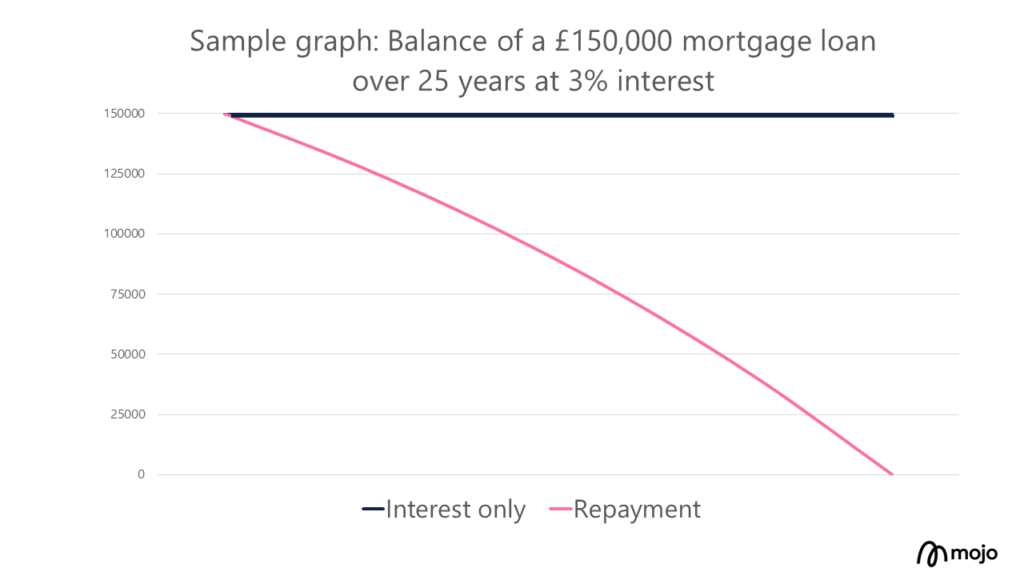

Interest-only mortgages are a type of mortgage where you only pay the interest on the loan each month, rather than paying off the loan itself.

This means that your monthly payments will be lower than with other types of mortgages, but you will need to have a plan in place to pay off the loan at the end of the mortgage term.

Interest-only mortgages are generally only available to borrowers who can demonstrate they have a suitable repayment vehicle, such as an investment or savings plan, to pay off the loan at the end of the term.

Repayment Mortgages

Repayment mortgages are a type of mortgage where you pay off the loan and the interest each month. This means that your mortgage balance will gradually decrease over time, until it is fully repaid at the end of the mortgage term.

Repayment mortgages are the most common type of mortgage in the UK, and they provide the security of knowing that you will own your property outright at the end of the mortgage term.

Flexible mortgages

Flexible mortgages allow you to make overpayments, underpayments or take payment holidays, which can be particularly useful for those with irregular income or who want to pay off their mortgage faster.

These mortgages can be very flexible, but they may also come with higher interest rates and fees.

Self-build mortgages

If you’re planning on building your own home, a self-build mortgage can be a good option. This type of mortgage provides staged payments to cover the cost of the build as it progresses, rather than a lump sum.

However, they can be more difficult to obtain and may require higher deposits.

Final Thoughts

Choosing the right mortgage can be a daunting task, but it’s important to understand the different types of mortgages available to you. By considering your circumstances and financial goals, you can find a mortgage that suits your needs and budget.

Whether you’re a first-time buyer, self-employed, or looking to remortgage, there is a mortgage out there for you. Speak to a qualified mortgage adviser to find out which type of mortgage is right for you and your individual circumstances.

Remember, taking out a mortgage is a big financial commitment, so it’s important to do your research and seek professional advice before making any decisions. With the right advice and guidance, you can find the most suitable mortgage for your needs and make your property dreams a reality.

| Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited. 26th May 2023 |